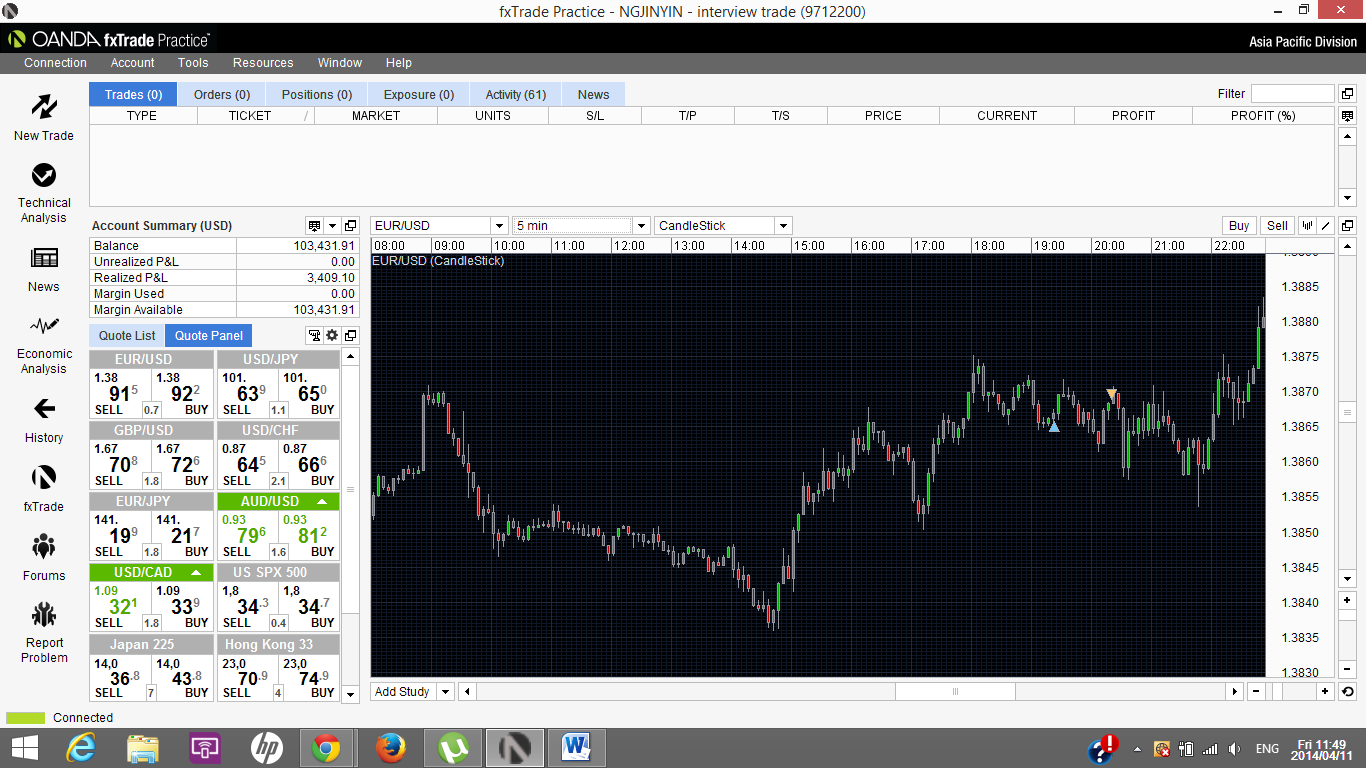

Two quick profit takings and one cut loss trades today.

Disclaimer: This is purely for sharing purpose only, not a trading advice or instruction.

Disclaimer: This is purely for sharing purpose only, not a trading advice or instruction.

Trade: Sell on a strong but gradual downtrend, after pullback and downward confirmation. Took position on short term pullback. Took profit immediately at next bar after 5.9 pips.

Review: Quick and decisive trade. Since trend is gradual, it might take very long to hit intended profit again.

Trade: Sell after spotting Doji on top of 15 min bar uptrend, and next bar falls before the bar before (reversal signal). Take profit set at uptrend trend line, anticipating a strong pullback. 4.4 pips profit.

Review: Quick and decisive trade. As anticipated, there was a strong pullback after 5 bars.

Trade: Sold upon doji at top of uptrend, anticipating a strong pullback. Didn't happen. Cut loss at 2.8 pips after next pullback until trend line.

Review: Risky trade to go against long term trend. However, cut loss was done well at next pullback to retain capital.

Summary

If a trade against the general trend is taken, profit taking must be quick, preferably within the next 3 bars, in case trend continues. If price moves against position, take cut loss at the next major pullback. This type of trade is not recommended.