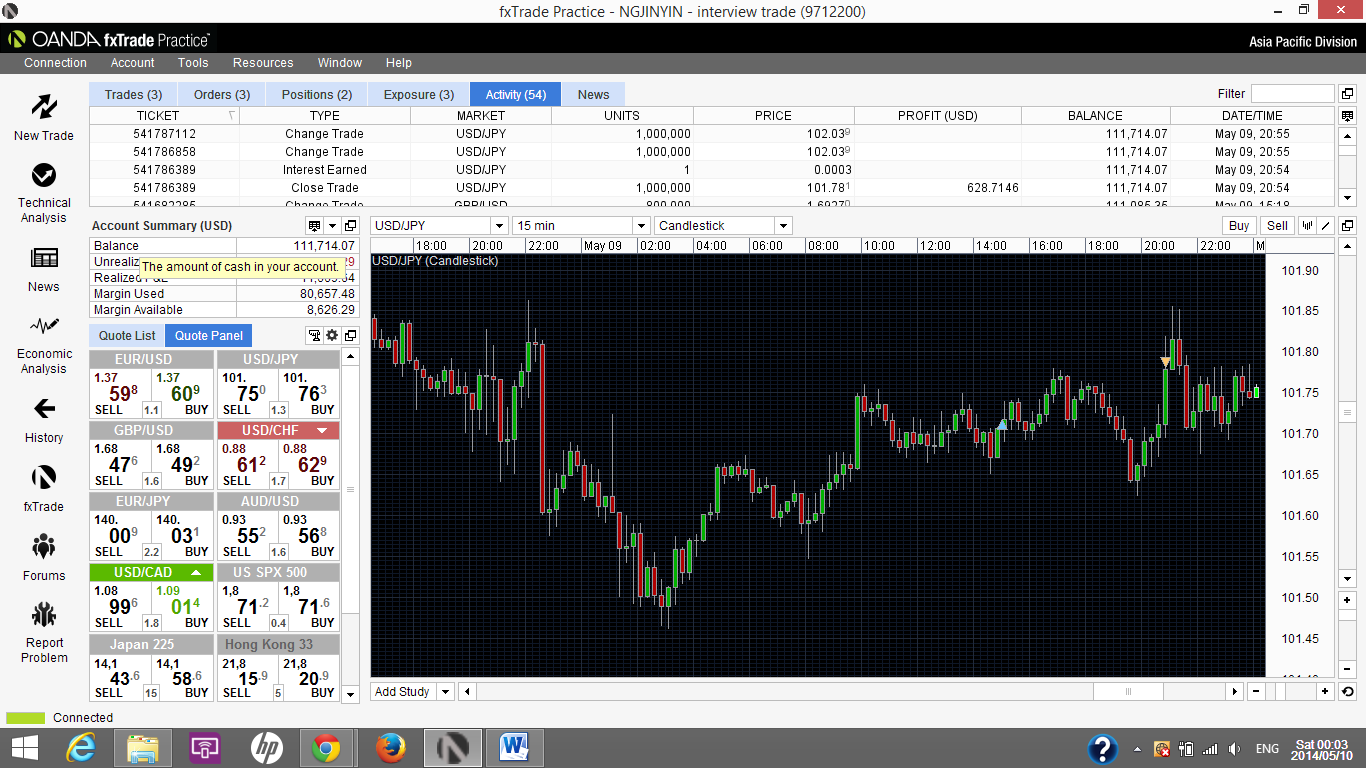

Haven't been able to catch the early trades due to work commitments. Today's only trade is riding on a strong bearish sentiment on the EUR/JPY pairing. JPY is regaining it's strength and seems to be doing so for the next few months.

Disclaimer: This is purely for sharing purpose only, not a trading advice or instruction.

Trade: Short on downtrend pullback. Take profit at 19.3

pips.

Review: Both short and long term trends were down, same

thing for USD/JPY pairing. This means

the bullish sentiment for JPY is still very strong. Trade was initiated by

limit order that was placed along downtrend line and caught a peak before

continuing downwards. Quick and relatively large profit of 19.3. Good trade.

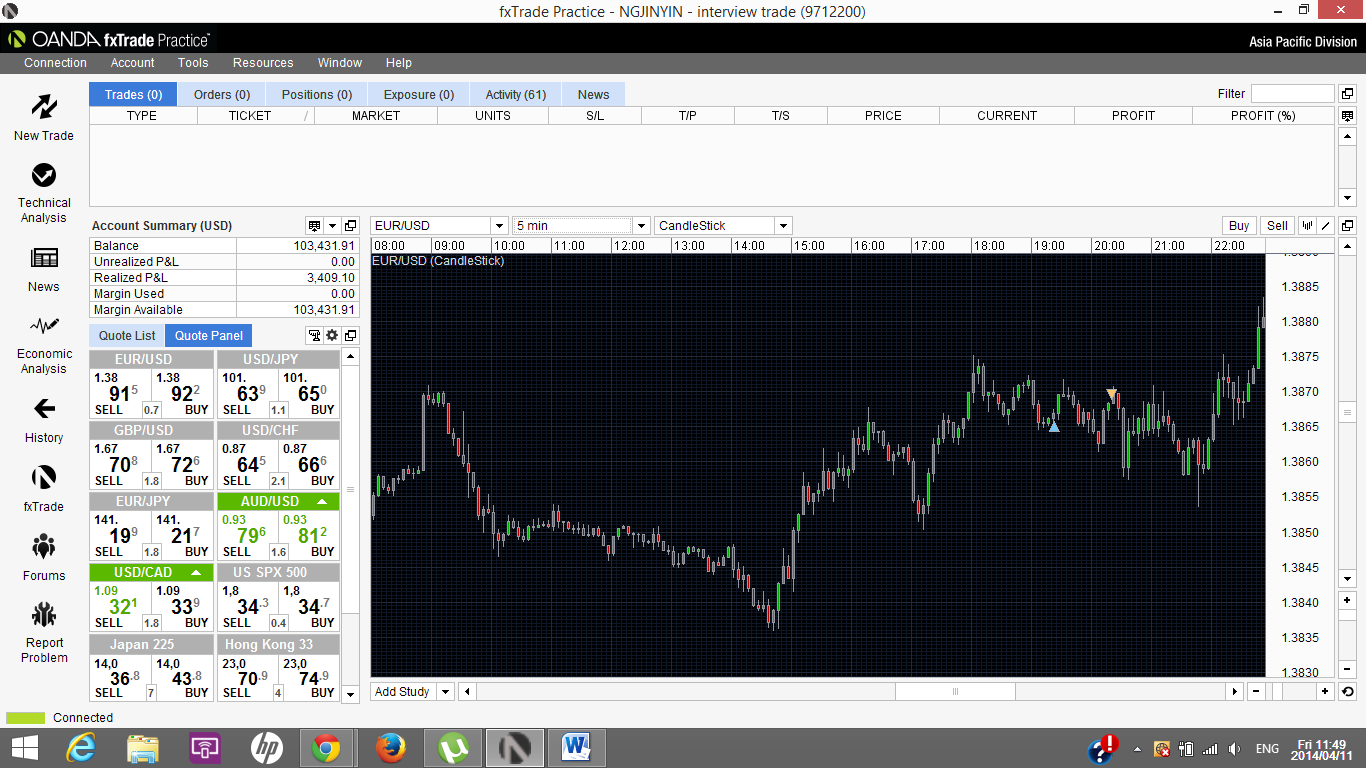

Trade: Buy at uptrend pullback after confirmation of

continuation. Averaged down on same bar. Quick exit after 3 bars at average of

9 pips profit.

Review: After confirmation of upward continuation (kicker bar touching trendline), I waited

to see if price would come down for a better position to buy. That decision was

rewarded by a mini pullback followed by a big green bar to solidify profits. Confidence of taking long position was strengthened by medium term long trend on the 1 hr chart.

Summary

Both trades today were in-sync with the longer term trends shown on the 1hr charts. This gave me more confidence to take my trades and wait out for a profit, although the trades today were quite swift. This also makes a difference in the confidence to average up/down for a better overall position.