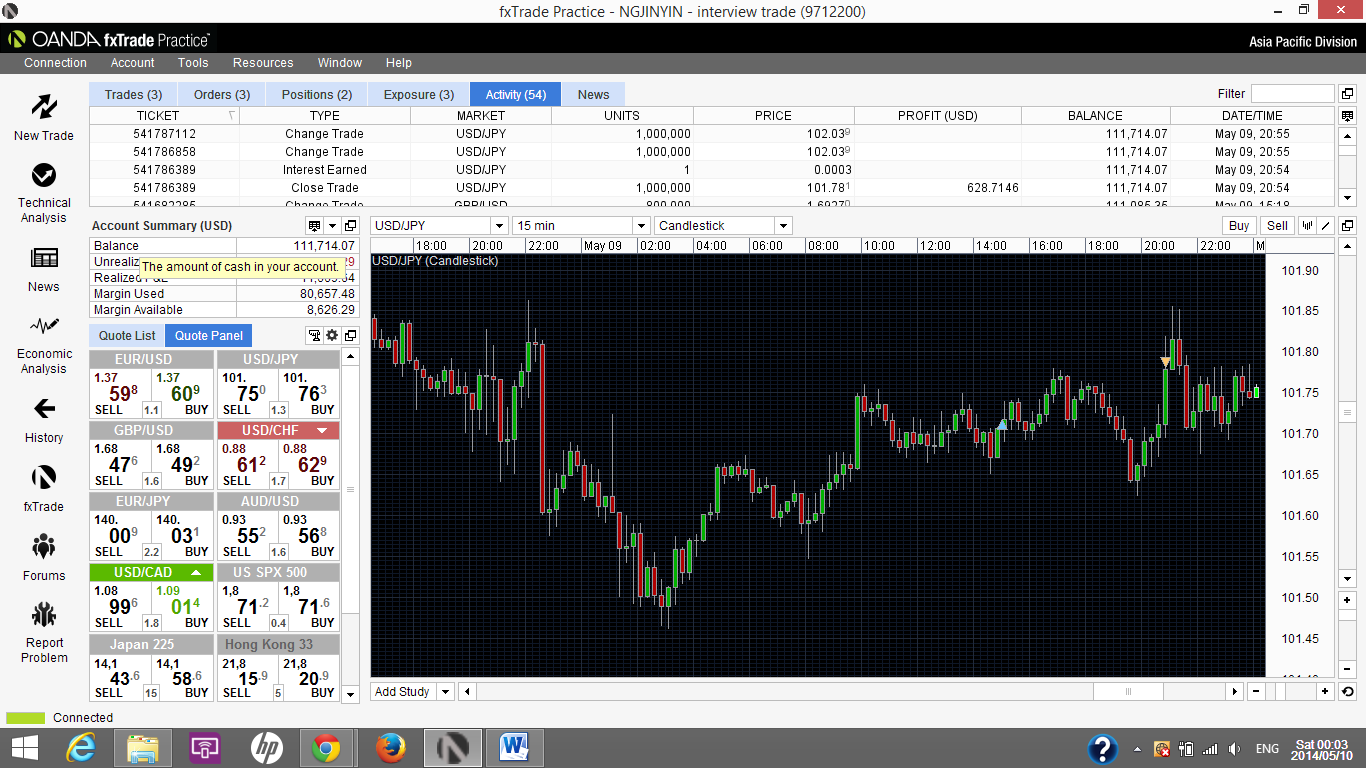

Trend was more obvious on the JPY related pairings today. Did 2 good shorts today, and also learnt a good lesson about not trading against the long term trend. See second trade below.

Disclaimer: This is purely for sharing purpose only, not a trading advice or instruction.

Trade: Sell on downtrend pullback. End of pullback is

confirmed by long red bar after dojis. Take profit set at near previous low.

Trade closed at 10 pips profit.

Review: Obvious downtrend. Waited for confirmation of

downtrend continuation before taking position. Good trade.

Trade: Trying to take advantage of short term pullback to

gain a little profit on a general down trend. Market moved against trade. Cut

loss at previous support level. Loss 5 pips.

Review: Too hasty to make profit during indecisive market

period. Should avoid if not clear whether trend is reversing or continuing. Bad trade.

Trade: Short on downtrend continuation after head and

shoulders pattern. Previous low was broken, and downward momentum shown by red

bar after long legged doji. Took profit at 5 pips.

Review: Head and shoulders pattern is more obvious when

viewed on the 30min chart. Even without

the head and shoulders chart pattern, the downward trend reversal is eminent

with the lower troughs and lower peaks. Since downtrends typically last shorter,

and have a larger momentum, I would go in early, as soon as trend continuation

is confirmed.

Summary

Short positions usually last shorter, hitting profit target faster. This reduces market risk as well as your heartbeat. But you have to take advantage of it early. Avoid trading during pending market news, sideway trend or consolidation, or if there are any signs of trend reversal coming.